Natural catastrophes: how modelling can give European risk managers a new perspective

October 28, 2019

By Corinne Vitrac, Chief Executive of AXA XL Risk Consulting & Martin Vinkenfluegel, Risk Consulting Regional Manager for Europe, AXA XL

Natural catastrophes can have a huge impact on a company, its operations and its workforce. For risk managers, estimating the annual losses suffered by a portfolio of assets and getting a sense of how an event could affect key facilities or locations is indispensable to allocate resources and prioritise risk mitigation efforts.

During the first half of this year, natural catastrophes caused insured losses of more than €1.3 billion in Germany alone, according to the German insurance association, Gesamtverband der Deutschen Versicherungswirtschaft e.V. Much of that loss total was caused by severe thunderstorms and violent hailstorms combined with a heatwave.

Hailstorms also caused widespread losses in Italy and Greece earlier this year, while wildfires ravaged areas of Spain after a period of intense hot weather. Last year, the Seine burst its banks after rising to four times its normal level following rainfall of double the annual average during Paris’ second wettest winter since 1900.

The list of weather-related events goes on. And other types of natural catastrophe are also a cause for concern for risk managers in Europe.

The devastating earthquake that hit central Italy in 2016 resulted in widespread damage to buildings and tragically resulted in the deaths of 295 people. The earthquake left about 4,000 people without homes and injured more than 400. Just seven years previously, the Abruzzo area of central Italy was left reeling from the after effects of another earthquake which left more than 300 people dead and more than 70,000 homeless. Catastrophic events have a devastating, long-lasting effect on people’s lives and the communities in which they live and work.

In the industrial sector, a loss at one facility can propagate worldwide because of business interruption and logistic or supply-chain disruption.

Understanding natural catastrophes and the way they might affect clients’ operations is a vital part of the work insurers aim to do.

It is important to learn from experience and to leverage an extensive database of losses, covering both catastrophic and non-catastrophic events. Gathering and examining years’ worth of loss histories from flood events that have affected clients all over the world means we are better equipped to estimate what damage a client might be exposed to the next time water reaches a certain height.

But past loss data cannot provide a complete picture, especially considering the rapid changes in our society, environment and climate.

A sound and transparent risk assessment should be always followed by an informed risk management decision, or a risk mitigation action.

To this end, models that can be adapted to the particular client profile can give us a better understanding of the reasons behind a given level of losses, either modelled or suffered in the past. Modelling catastrophe risk is a collaborative effort. Catastrophe modelers, risk engineers and natural scientists work closely together to understand the genesis of natural events, investigate the range of possible damages and estimate the impacts associated with given natural hazards.

When we then add in data about our clients’ specific assets in exposed areas, such as building size and occupancy, construction type and age, we are able to give them insights into where and how they are most at risk.

The tailored assessments of an organisation’s vulnerabilities to natural catastrophes, and the potential impacts of those on the bottom line, give risk managers and their CFOs valuable tools to determine how to manage risk. All the above enables us to work with clients to give them tailored risk analysis and consulting solutions, ranging from portfolio-wide stochastic simulations to site-specific engineering risk analyses and surveys.

For example, the estimates of annual insured and financial losses that models can produce give risk managers a greater sense of which locations should be given more risk management attention and spend, and what levels of insurance limits are appropriate for specific locations as well as the company overall.

Catastrophe modelling is just a starting point towards a structured risk management and effective loss prevention. In fact, more detailed engineering analyses should be dedicated to the most risk-exposed locations, or strategic ones, in order to smooth peaks in the company risk profile and prevent catastrophic impacts.

For example, working with academic partners, we have developed tools that perform desk-based probabilistic simulations of flood and earthquakes at a given site and produce refined numerical analyses of the structural responses to these events.

This enables us to quantify the full range of structural and non-structural damages that would be suffered by each building in a given facility, under selected earthquake scenarios, with the relevant downtime and business interruption implications.

Similarly, we can simulate the genesis, runoff, flow velocity, and duration of floods affecting a specific site, in a given river-catchment area, and model the related consequences.

A sound and transparent risk assessment should be always followed by an informed risk management decision, or a risk mitigation action. Though dedicated site surveys, risk engineers can provide tailored risk mitigation solutions, which may include the reduction of the physical vulnerability of given buildings and equipment, or the improvement of emergency response.

No two natural hazard events, nor sites, are exactly the same, of course, which means that risk modelling is only truly valuable if it is iterative and interactive. Our risk engineers and catastrophe modellers work closely with clients to explore the ways in which different assumptions or variables affect potential outcomes.

We are learning all the time, and this information becomes more and more powerful.

Nobody wants a natural catastrophe to happen, but the occurrence of these events is out of human control.

By harnessing modelling capabilities and using model outputs wisely, risk engineers can, we believe, give risk managers valuable insights into how to best manage their potential exposures, anticipate potential impacts and be better prepared.

This can make the difference between a loss and a disaster.

To contact the author of this story, please complete the below form

More Articles

- By Risk

- By Product

- By Region

Related Resources

The risk manager of tomorrow making data work for you

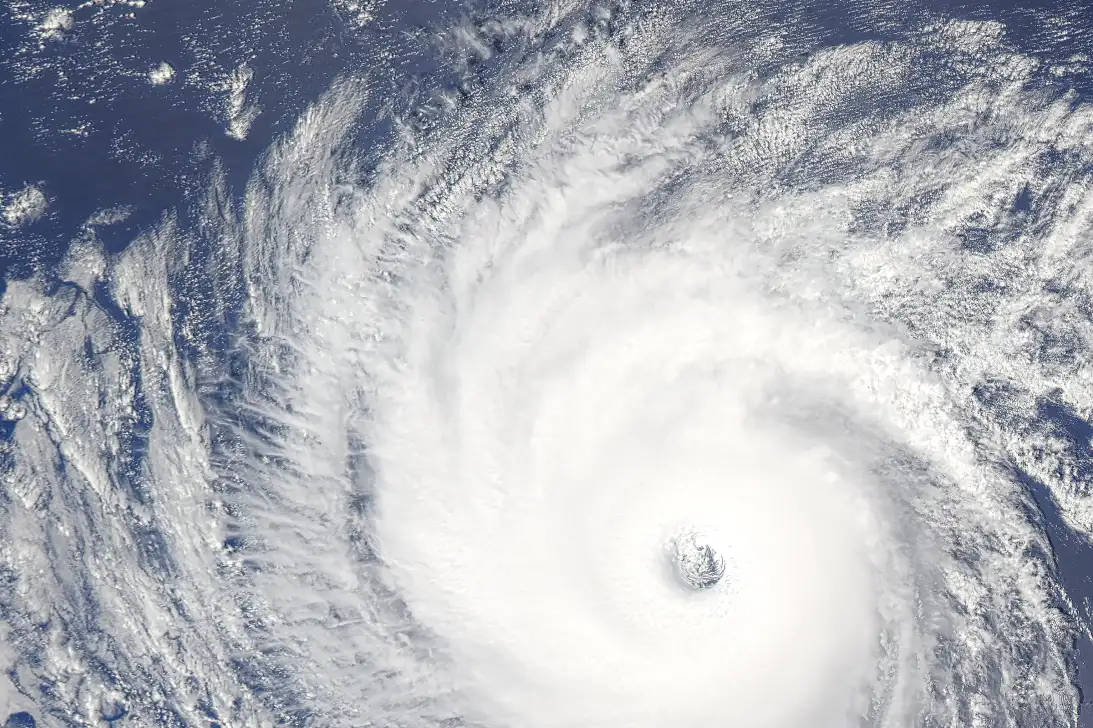

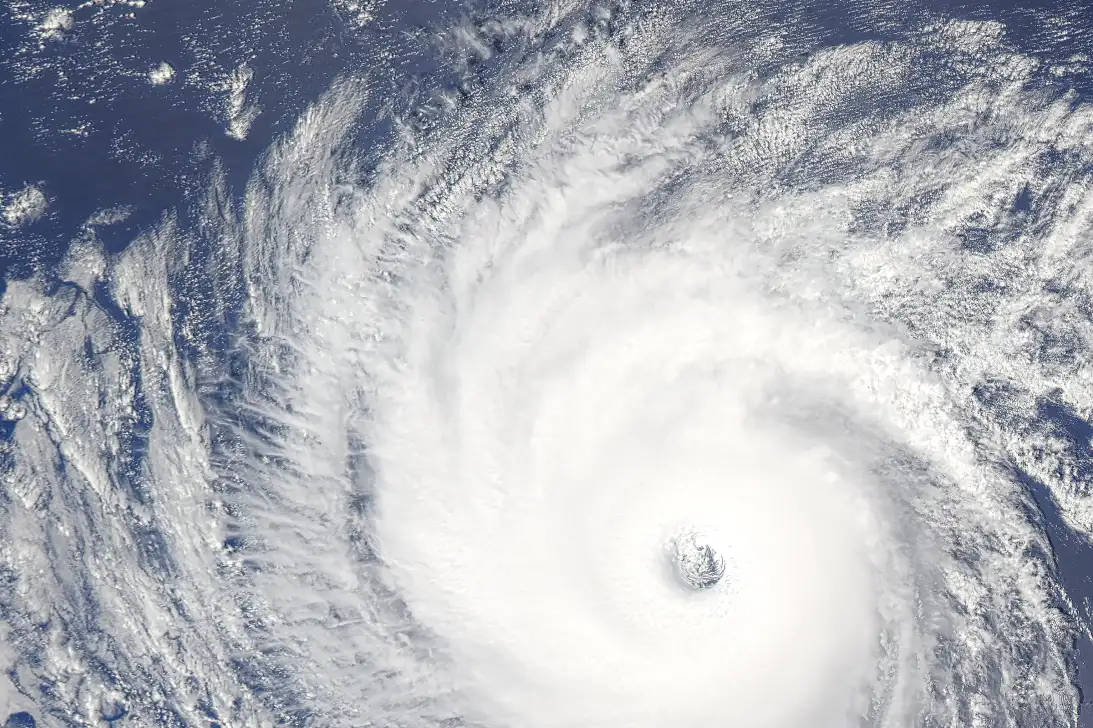

There’s a 100% chance a hurricane will strike somewhere in 2019. Be prepared!

Global Asset Protection Services, LLC, and its affiliates (“AXA XL Risk Consulting”) provides risk assessment reports and other loss prevention services, as requested. In this respect, our property loss prevention publications, services, and surveys do not address life safety or third party liability issues. This document shall not be construed as indicating the existence or availability under any policy of coverage for any particular type of loss or damage. The provision of any service does not imply that every possible hazard has been identified at a facility or that no other hazards exist. AXA XL Risk Consulting does not assume, and shall have no liability for the control, correction, continuation or modification of any existing conditions or operations. We specifically disclaim any warranty or representation that compliance with any advice or recommendation in any document or other communication will make a facility or operation safe or healthful, or put it in compliance with any standard, code, law, rule or regulation. Save where expressly agreed in writing, AXA XL Risk Consulting and its related and affiliated companies disclaim all liability for loss or damage suffered by any party arising out of or in connection with our services, including indirect or consequential loss or damage, howsoever arising. Any party who chooses to rely in any way on the contents of this document does so at their own risk.

US- and Canada-Issued Insurance Policies

In the US, the AXA XL insurance companies are: Catlin Insurance Company, Inc., Greenwich Insurance Company, Indian Harbor Insurance Company, XL Insurance America, Inc., XL Specialty Insurance Company and T.H.E. Insurance Company. In Canada, coverages are underwritten by XL Specialty Insurance Company - Canadian Branch and AXA Insurance Company - Canadian branch. Coverages may also be underwritten by Lloyd’s Syndicate #2003. Coverages underwritten by Lloyd’s Syndicate #2003 are placed on behalf of the member of Syndicate #2003 by Catlin Canada Inc. Lloyd’s ratings are independent of AXA XL.

US domiciled insurance policies can be written by the following AXA XL surplus lines insurers: XL Catlin Insurance Company UK Limited, Syndicates managed by Catlin Underwriting Agencies Limited and Indian Harbor Insurance Company. Enquires from US residents should be directed to a local insurance agent or broker permitted to write business in the relevant state.

AXA XL, as a controller, uses cookies to provide its services, improve user experience, measure audience engagement, and interact with users’ social network accounts among others. Some of these cookies are optional and we won't set optional cookies unless you enable them by clicking the "ACCEPT ALL" button. You can disable these cookies at any time via the "How to manage your cookie settings" section in our cookie policy.